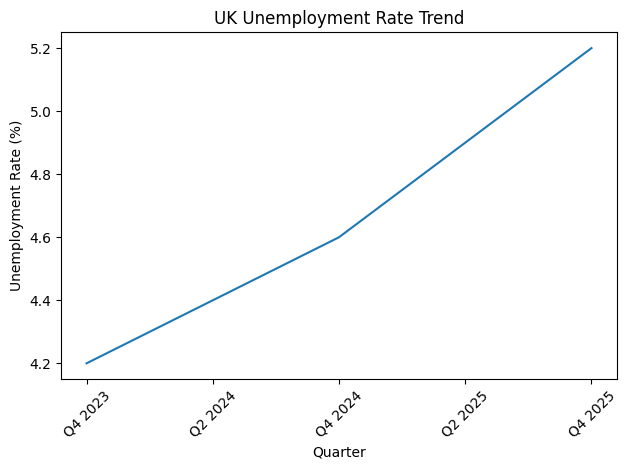

UK unemployment climbed to 5.2% in the three months to December 2025, the highest level in nearly five years.

This rise, beyond a simple percentage, reflects structural shifts, policy effects, age-specific dynamics, and questions about underemployment and future prospects:

- Payroll employment is shrinking.

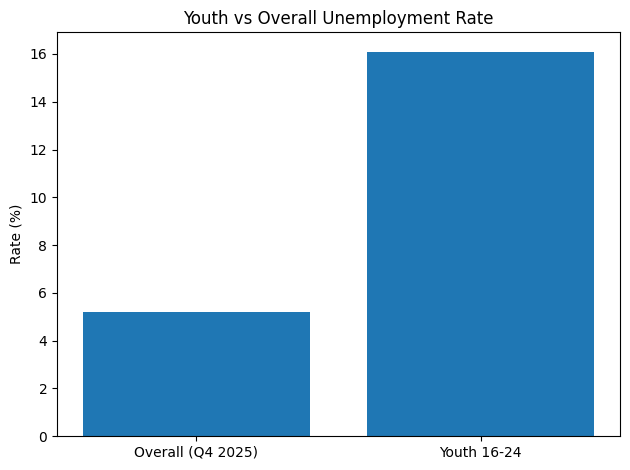

- Youth unemployment has surged to 16.1%.

- Redundancies are rising.

- Economic inactivity remains elevated at 20.8%

The Office for National Statistics (Feb 2026) has reported that vacancies have fallen dramatically since their post-pandemic peak, and the number of people facing layoffs is climbing. In the final quarter of 2025, redundancies rose to 145,000, hitting a rate of 4.9 per 1,000 employees. 1.88 million people aged 16 and over were unemployed in the three months to December 2025

While there have been increased job losses, wage growth and hiring have also slowed, increasing competition for jobs (e.g Revolut says 1.6 million applications were made for 5,000 vacancies it posted last year). The Institute for Employment Studies, in its report, highlights that there are over 2.1 million people outside the labour force who want to work.

So, the big question is, what is driving unemployment?

- Higher Labour Costs (National Insurance & Minimum Wage): For most companies, the increase in the National Insurance in the recent autumn budget, as well as the increase in minimum wage, means it has become more expensive to hire. Asda, Aldi, Currys, and other members of the British Retail Consortium raised the concern in a letter to the Chancellor of the Exchequer ahead of the autumn budget. Beginning in April, the rate for employer National Insurance Contributions (NICs) jumps to 15%, and the threshold at which they must start paying it drops drastically to £5,000. Faced with multi-billion-pound tax burdens and a rising minimum wage, businesses, especially in retail and hospitality, are reacting by freezing headcount, halting expansion plans, or actively shrinking their workforce.

- Artificial Intelligence (AI): AI is another driver as companies navigate the complexities of investing to boost productivity and assessing parts of their business where human intervention remains key. In a Morgan Stanley study, the UK is suffering the highest AI-related job losses among major economies, reporting an 8% net job loss linked directly to the technology.

Other factors, including persistent inflation and very limited economic growth, continue to put pressure on the UK labour market.

The key concern? Youth Unemployment.

The 5.2% figure is concerning, but the underlying demographic split is alarming. Youth unemployment (16–24-year-olds) has surged to 16.1%, roughly three times the national average. If prolonged, this cohort risks lower lifetime earnings, lower productivity contribution, and higher fiscal burden.

What is the outlook for this year?

The short answer is that the market will likely get slightly worse before it improves.

Economists and independent forecasters expect unemployment to continue creeping up, likely peaking around 5.3% to 5.6% by the spring of 2026 as the new National Insurance rules officially bite. However, 2026 is forecast to be a year of eventual recovery.

Inflation has finally cooled to roughly 3%, well down from its peak, increasing the likelihood of monetary easing. The Bank of England currently holds the base rate at 3.75%, but financial markets and economists at institutions like Morningstar and ING widely expect it to begin cutting rates as early as March 2026. As borrowing becomes cheaper throughout the year, businesses should regain confidence to invest and begin hiring again in the second half.

What should I do if I am unemployed?

Navigating a tight labour market requires a strategic and proactive approach. Rather than relying solely on traditional job boards, which are currently saturated with applicants, job seekers should focus heavily on the hidden job market. A significant percentage of available roles are never publicly advertised, making active networking essential. Reaching out to former colleagues, engaging with industry-specific LinkedIn groups, and directly contacting internal recruiters can help you uncover opportunities that bypass the crowded application pile.

Simultaneously, it is crucial to pivot toward skills-based applications. In a market where corporate budgets are squeezed, employers are increasingly hiring for specific, immediate competencies rather than just degrees or past job titles. By auditing your transferable skills, such as project management, data analysis, or customer relations, and tailoring your CV for every single application, you can explicitly demonstrate how your background solves an employer's immediate operational problems.

During this transitional period, upskilling defensively is one of the most effective ways to stand out. Closing skills gaps, particularly in digital literacy or AI tools relevant to your sector, adds immediate value to your resume.

Finally, embracing flexibility can provide a vital bridge. Consider contract work, freelance projects, or temporary roles through employment agencies as an excellent way to maintain a steady income and prevent long gaps on your resume. As companies are currently hesitant to commit to full-time hires due to the National Insurance hikes, these temporary positions are in higher demand and often convert to permanent roles once the economic outlook brightens.